In the financial services sector, new laws and rules are developed according to the "Lamfalussy Process”.

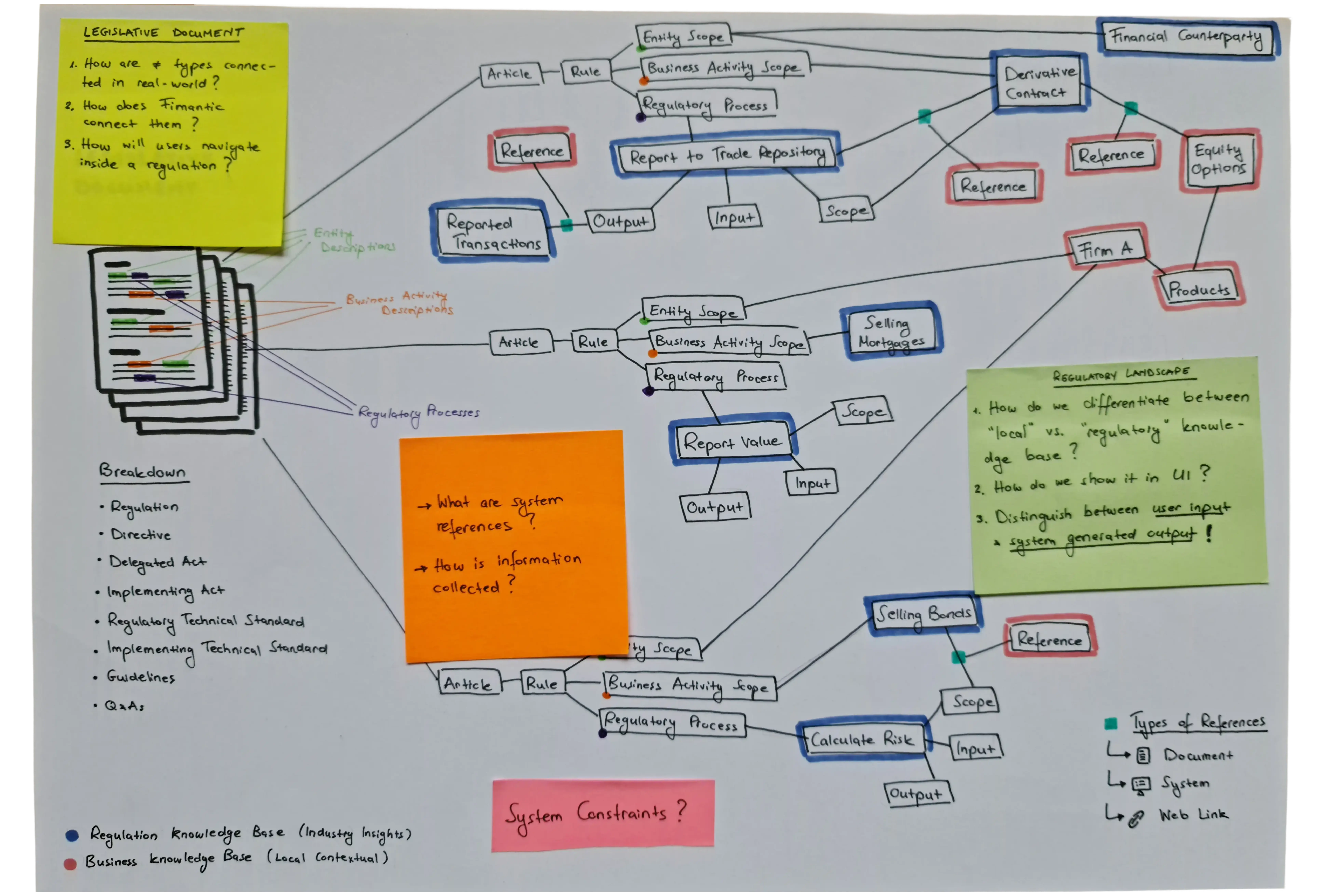

Broadly speaking, any given regulation refers to a particular entity of a business and it requires a particular regulatory process in order to prove compliance. More specifically, any given regulation contains articles, which contain rules. These rules specify to which entity they apply, to which business scope and what regulatory process it requires. Each process has inputs and outputs that can be tracked. Therefore if the regulation applies to an entity, it must perform a particular regulatory process and prove so, in order to be compliant.

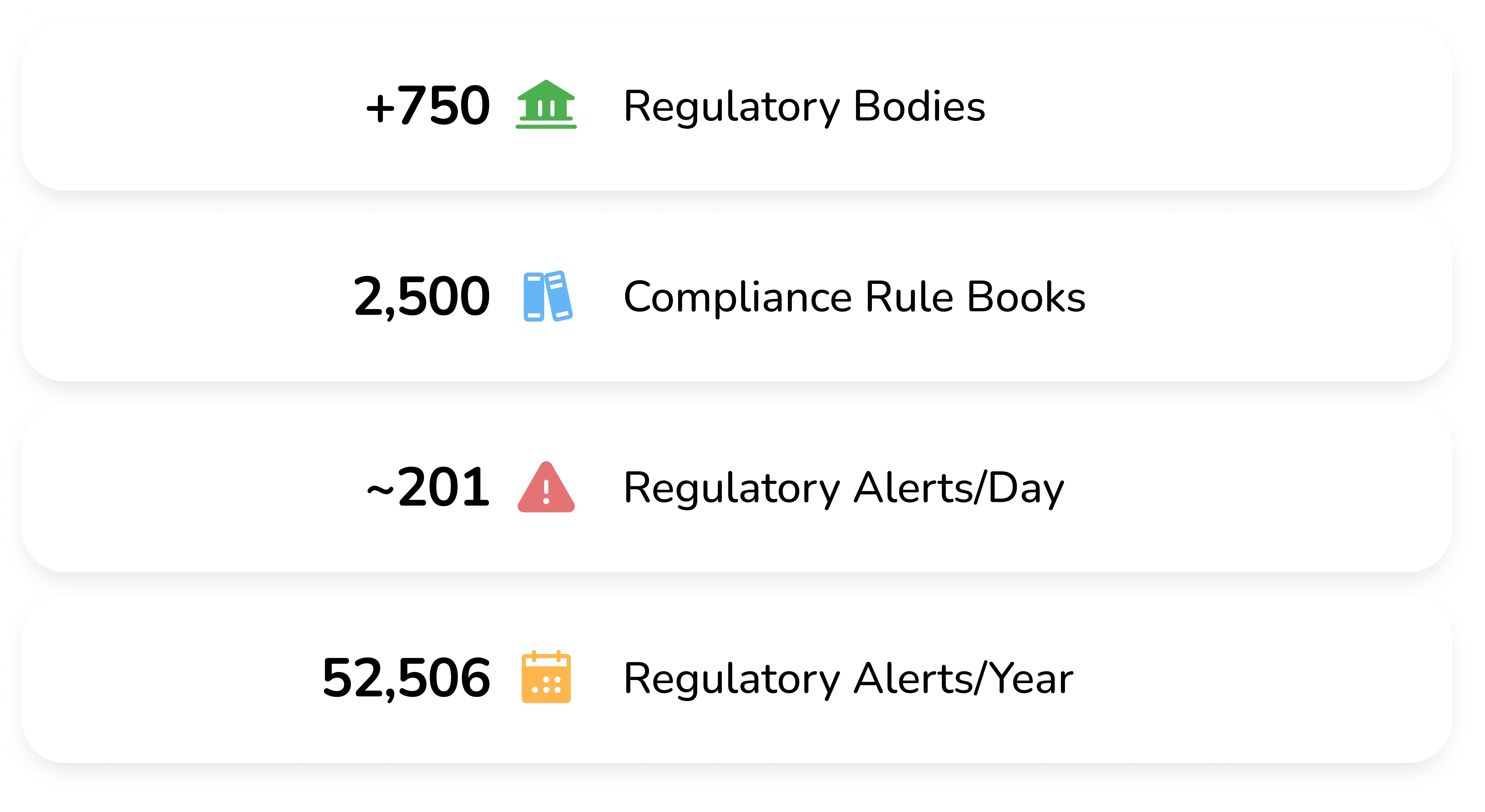

The sheer number of regulations that the financial service industry is responsible for tracking is huge. Regulations like Basel/CRD/CRR and MIFID/MIFIR comprise over 20,000 articles

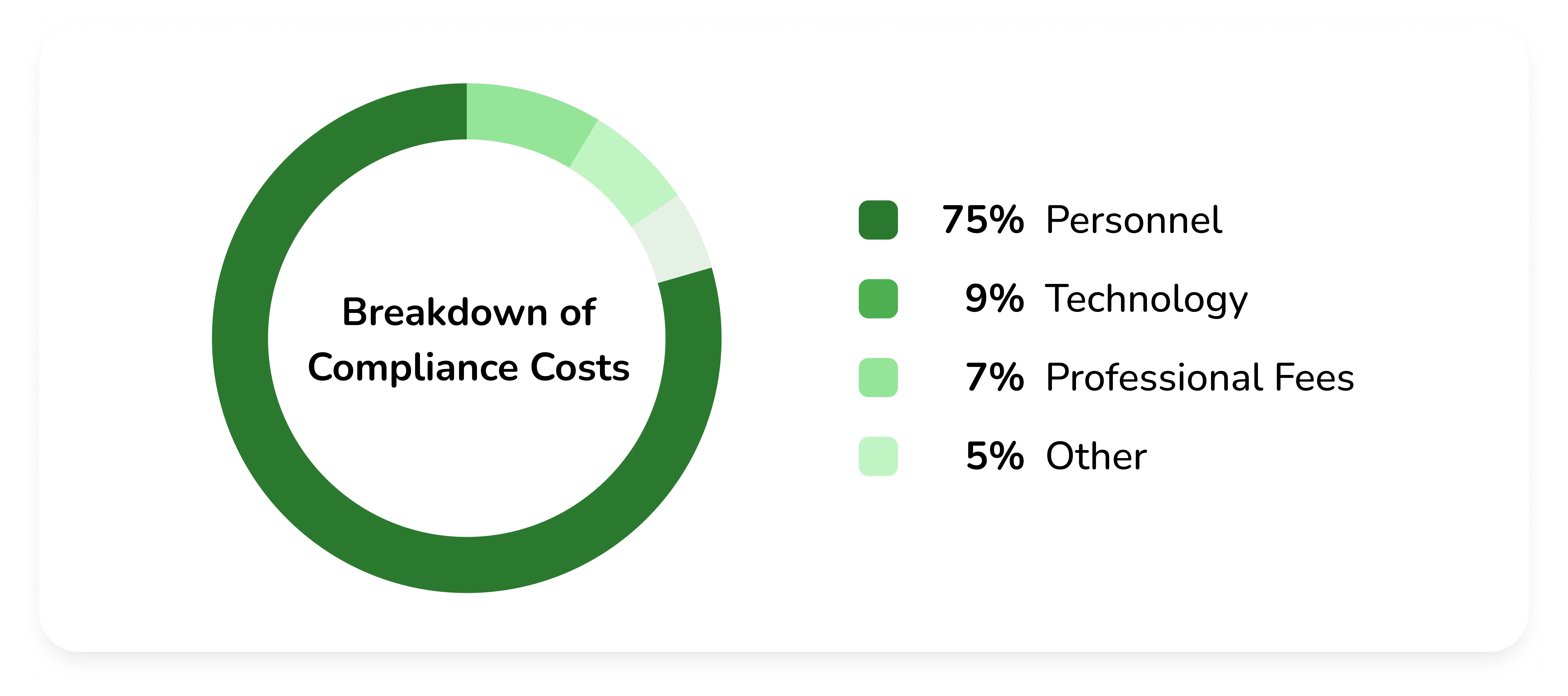

A report from McKinsey & Company across 20 large EU & US banks for the period of 2009-14, found that operating income had decreased by 10%, while regulatory fines and settlements increased by almost x45. It is not uncommon for a global bank to spend €1.5 billion on compliance costs on an annual basis (3%-10% of operating expenses) while others studies put the numbers as high up as 15%. Europe, for instance, accounts for 6.3% of global AML fines levied in the last 10 years, totaling $1.71 billion across 84 separate fines.

A financial auditor reviews a company's financial statements, documents, data, and accounting entries. They gather information from a company's financial reporting systems, account balances, cash flow statements, income statements, balance sheets, tax returns, and internal control systems. Typically they capture data manually using Microsoft Excel or Word. Their goal is to gain an understanding of the company's purpose, operations, financial reporting systems, and known or perceived errors in its organizational systems.

The information from an auditor's analysis is used to develop recommendations and specific action items, like suggesting changes to internal controls and financial reporting procedures to enhance the company's efficiency, cost-effectiveness, and overall performance. However, management has final say when it comes to adopting recommendations, accounting policies, and for establishing and maintaining internal controls.

— J.R., 47/M, Financial Auditor

Mapping users' needs to the existing framework

DEMO